Digital Lending Platform Market Size, Current Status, and Outlook 2030

Introduction

The Digital Lending Platform Market represents the ecosystem of software-based systems that enable financial institutions, fintech companies, and non-banking lenders to provide loans digitally. These platforms automate the entire lending lifecycle, including borrower onboarding, credit assessment, loan disbursement, repayment tracking, and regulatory compliance. They leverage technologies such as artificial intelligence (AI), machine learning (ML), cloud computing, and data analytics to enhance efficiency and reduce operational costs.

This market has become integral to the global financial services sector. It enables rapid loan approvals, enhances customer experience, and broadens credit access, especially in underserved regions. As of 2024, the global digital lending platform market is estimated to be worth about USD 15 billion and is expected to witness sustained growth due to the acceleration of digital transformation in banking and the rise of alternative lending models. The demand for fast, paperless, and mobile-first financial services is driving its adoption across both developed and emerging markets.

Learn how the Digital Lending Platform Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market

The Evolution

The digital lending platform market has evolved rapidly over the past two decades. Initially, lending was entirely manual and paper-based, involving extensive documentation and physical credit checks. Early online lending systems appeared in the 2000s, primarily offering personal and payday loans through basic web portals. These systems lacked automation and relied on manual underwriting.

The introduction of cloud computing and advanced analytics transformed the industry. By the 2010s, platforms started integrating AI-driven credit scoring, real-time data verification, and automated workflows. The emergence of fintech firms offering peer-to-peer (P2P) lending significantly disrupted traditional lending models, pushing banks to adopt digital systems.

Major milestones include the integration of open banking APIs, real-time payment systems, and mobile-first lending solutions. The COVID-19 pandemic accelerated digital adoption as physical banking access declined, creating a surge in demand for online lending services. Today’s platforms feature advanced fraud detection, compliance automation, and predictive analytics, enabling lenders to process loans at scale with minimal human intervention.

Market Trends

The digital lending platform market is shaped by several clear trends. One major trend is the shift toward cloud-based lending solutions. Cloud infrastructure offers scalability, lower upfront costs, and easier integration with third-party fintech services, making it the preferred deployment model for many lenders.

Artificial intelligence and machine learning are being increasingly deployed for credit scoring, risk assessment, and customer behavior prediction. This enhances decision-making accuracy and speeds up loan approvals. Embedded lending, where lending services are integrated directly into e-commerce or enterprise software platforms, is also gaining momentum.

The rise of mobile-first lending platforms reflects changing consumer preferences, especially among younger demographics. These platforms offer instant loan applications, approvals, and disbursals through smartphone apps, driving higher adoption in emerging economies.

Regulatory technology (RegTech) integration is another key trend. Platforms are embedding automated compliance modules to adhere to evolving financial regulations and prevent money laundering or fraud. Additionally, digital identity verification and e-signature capabilities are becoming standard features, enabling end-to-end digital workflows.

Challenges

Despite its growth, the digital lending platform market faces several challenges. Regulatory uncertainty is a significant barrier, as financial regulations vary widely across regions and change frequently. Compliance with data privacy laws, anti-money laundering (AML) directives, and consumer protection regulations increases operational complexity.

Cybersecurity threats are a critical risk. Handling sensitive financial and personal data makes digital lending platforms attractive targets for cyberattacks. Any breach can result in regulatory penalties, reputational damage, and customer attrition.

Integration challenges also persist. Many traditional banks operate on legacy core systems that are difficult to integrate with modern digital lending platforms. This slows down digital transformation and increases implementation costs.

Other challenges include high initial setup costs for advanced platforms, limited digital infrastructure in some developing regions, and the risk of credit defaults due to rapid loan disbursals without adequate underwriting controls.

Market Scope

By Type:

-

Loan Origination Platforms

-

Loan Servicing Platforms

-

Risk and Compliance Management Platforms

-

End-to-End Lending Suites

By Deployment:

-

Cloud-Based Platforms

-

On-Premises Platforms

By Component:

-

Software

-

Services (Implementation, Integration, Consulting, Support)

By Application:

-

Personal Loans

-

Business Loans

-

Mortgage Loans

-

Auto Loans

-

SME Financing

Regional Analysis:

-

North America: Mature market driven by strong fintech adoption and regulatory frameworks.

-

Europe: Rapid adoption due to open banking regulations and strong digital banking infrastructure.

-

Asia-Pacific: Fastest-growing region driven by smartphone penetration and financial inclusion initiatives.

-

Latin America: Expanding fintech ecosystem supporting digital lending growth.

-

Middle East & Africa: Emerging market with increasing mobile banking adoption and regulatory modernization.

End-User Industries:

-

Banks and Financial Institutions

-

Non-Banking Financial Companies (NBFCs)

-

Fintech Companies

-

Credit Unions

-

Peer-to-Peer Lending Platforms

Market Size and Factors Driving Growth

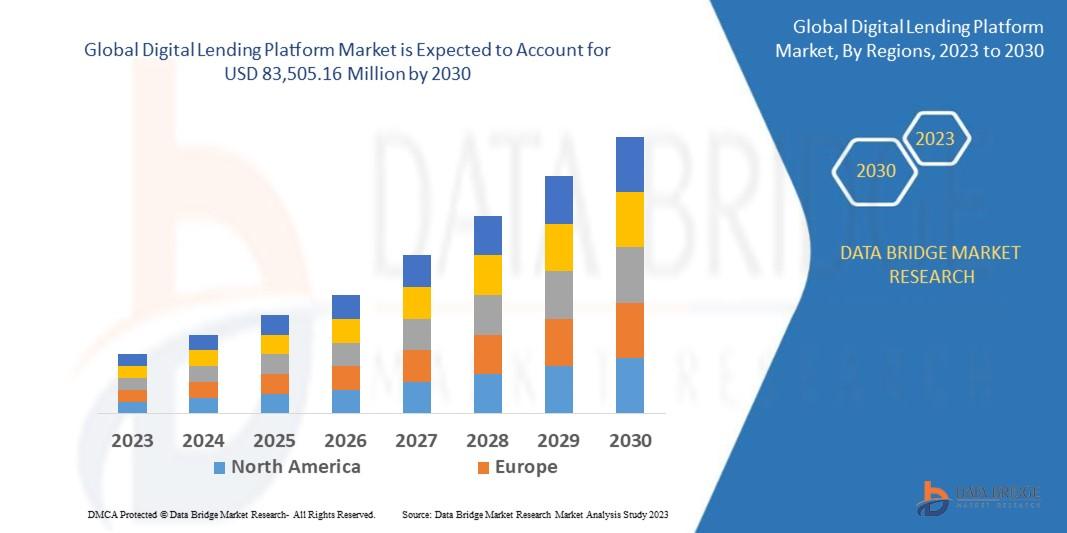

Data Bridge Market Research analyses that the global digital lending platform market which was USD 20,215.23 million in 2022, is expected to reach USD 83,505.16 million by 2030, and is expected to undergo a CAGR of 19.4% during the forecast period of 2023 to 2030.

Digital transformation initiatives by banks and financial institutions are the primary growth driver. Institutions are investing heavily in automation to reduce costs, improve turnaround times, and enhance customer experience. Cloud-based platforms are particularly attractive because they allow scalable deployment and fast time-to-market.

The surge in smartphone usage and internet penetration is expanding the addressable customer base for digital lending. In emerging regions, digital platforms are enabling financial inclusion by providing access to credit for unbanked and underbanked populations.

Advances in AI and data analytics are boosting adoption by enabling better credit risk assessment and personalized lending offers. Real-time credit scoring using alternative data, such as transaction history or social data, is expanding access to borrowers without traditional credit histories.

Government policies promoting cashless economies and digital financial services are also contributing to growth. Regulatory support for open banking frameworks encourages innovation and collaboration between banks and fintech firms, further driving market expansion.

Conclusion

The Digital Lending Platform market is transforming the global lending ecosystem by enabling faster, more efficient, and accessible credit delivery. With a strong growth trajectory projected through 2035, the market is becoming a critical component of modern financial infrastructure.

Innovation and security will be key to sustaining growth. Platforms that offer AI-driven risk management, automated compliance, and seamless mobile experiences will gain a competitive edge. Embracing cloud deployment, open banking integrations, and embedded finance models will be crucial for market players.

Opportunities are especially strong in emerging regions where digital financial inclusion is expanding. Companies that invest in localized solutions, robust cybersecurity, and strategic partnerships with banks and fintech firms are well-positioned to capture market share in this rapidly evolving sector.

Frequently Asked Questions (FAQ)

Q1: What is a Digital Lending Platform?

A digital lending platform is a software-based system that automates the loan lifecycle, including application, approval, disbursement, and servicing, using technologies like AI and cloud computing.

Q2: Who uses digital lending platforms?

Banks, fintech companies, non-banking financial institutions, credit unions, and peer-to-peer lending firms use digital lending platforms.

Q3: What drives the growth of the digital lending platform market?

Key drivers include digital transformation in banking, increasing internet penetration, AI and data analytics adoption, and government support for digital finance.

Q4: What is the expected growth rate of the market?

The market is projected to grow at a CAGR of about 12.5% from 2024 to 2035.

Q5: Which region is expected to show the highest growth?

Asia-Pacific is expected to show the highest growth due to rising smartphone penetration, fintech innovation, and financial inclusion initiatives.

Browse More Reports:

Asia-Pacific Solid Phase Extraction Market

Europe Solid Phase Extraction Market

Middle East and Africa Solid Phase Extraction Market

North America Solid Phase Extraction Market

India, South Korea, Singapore, Malaysia and Spain Spirits Market

Asia-Pacific Sports Analytics Market

North America Sports Analytics Market

Indonesia Talc Market

Thailand Talc Market

Europe Talc Market

South East Asia and Middle East and Africa Talc Market

North America Telecom Managed Services Market

Europe Telecom Managed Services Market

North America Thermal Insulation Packaging Market

Asia-Pacific Thermal Insulation Packaging Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Music

- Travel

- Technology

- AI

- Business

- Wellness

- Theater

- Sports

- Shopping

- Religion

- Party

- Other

- Networking

- Art

- Literature

- Home

- Health

- Gardening

- Games

- Food

- Fitness

- Film

- Drinks

- Dance

- Crafts

- Causes