Asia-Pacific Digital Lending Platform Market Value Analysis and Current Status 2032

Introduction

The Asia-Pacific Digital Lending Platform Market represents the ecosystem of software solutions and technological infrastructures that enable financial institutions, fintech companies, and other lenders to deliver credit products digitally. These platforms facilitate the complete lending lifecycle, from application and credit assessment to disbursement and repayment, through online or mobile channels.

Digital lending platforms have emerged as crucial tools in modern financial services due to their ability to improve operational efficiency, reduce turnaround times, and enhance customer experience. Globally, digital lending has reshaped the credit industry by enabling financial inclusion, especially for underbanked populations. In the Asia-Pacific region, rapid digitization, a growing fintech ecosystem, and expanding smartphone penetration have accelerated market growth. As of 2024, the Asia-Pacific digital lending platform market is estimated to be valued at around USD 6.8 billion, making it one of the fastest-growing regional markets globally.

Learn how the Asia-Pacific Digital Lending Platform Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market

The Evolution

The development of digital lending platforms in Asia-Pacific can be traced back to the early 2010s when fintech startups began introducing alternative credit models leveraging mobile technology. The rise of mobile banking in countries like China, India, and Singapore laid the groundwork for digital credit systems.

Key milestones include the launch of peer-to-peer (P2P) lending networks, the integration of artificial intelligence-based credit scoring models, and the deployment of blockchain technology for secure and transparent lending. Traditional banks gradually embraced digital platforms to remain competitive. Regulatory sandboxes in several Asia-Pacific countries encouraged innovation while ensuring consumer protection. Over time, the market evolved from simple loan origination systems to comprehensive end-to-end lending suites that integrate data analytics, cloud computing, and automated risk assessment.

The demand shift from traditional branch-based loans to instant, app-based credit is a defining factor in this evolution. Digital-native consumers and small businesses now expect seamless credit access without extensive paperwork or long approval timelines.

Market Trends

The Asia-Pacific digital lending platform market is undergoing significant transformation driven by several emerging trends:

-

AI and Machine Learning Integration: Platforms are embedding advanced analytics for real-time credit scoring, fraud detection, and predictive risk assessment.

-

Cloud-Based Deployment Models: Cloud infrastructure enables scalability, cost-efficiency, and faster implementation, driving widespread adoption among regional banks and non-banking financial companies.

-

Rise of Embedded Finance: Lending features are being integrated into e-commerce, ride-hailing, and payment platforms, creating new revenue streams.

-

RegTech Adoption: Regulatory technology solutions are being used to ensure compliance with dynamic regional financial regulations.

-

Growing SME Lending: There is increased focus on serving small and medium-sized enterprises with flexible credit lines, invoice financing, and microloans through digital channels.

-

Mobile-First Platforms: High smartphone penetration and mobile internet access are driving demand for app-based lending solutions, especially in rural and semi-urban areas.

The regional market is seeing strong adoption in economies like China, India, Indonesia, and Australia, where fintech investments and supportive government policies are accelerating technological uptake.

Challenges

Despite robust growth, the market faces several challenges:

-

Regulatory Complexity: Diverse and evolving financial regulations across countries create compliance burdens for platform providers.

-

Cybersecurity Risks: The digitization of lending increases vulnerability to data breaches, identity theft, and financial fraud.

-

Credit Risk Management: Reliance on alternative data for credit scoring can lead to inaccurate risk assessment if not properly validated.

-

High Initial Setup Costs: Building comprehensive lending platforms requires significant investment in technology and talent.

-

Limited Digital Literacy: In some emerging markets, low digital literacy levels hinder widespread adoption.

-

Competition from Traditional Banks: Established banks with legacy customer bases are launching their own digital platforms, intensifying competition.

These barriers can slow market expansion and require coordinated efforts from regulators, financial institutions, and technology vendors to mitigate.

Market Scope

The Asia-Pacific digital lending platform market can be segmented by component, deployment mode, end-user, and geography.

By Component

-

Solutions: Loan origination, loan management, risk and compliance management, analytics, decisioning systems.

-

Services: Consulting, integration, support, and maintenance.

By Deployment Mode

-

Cloud-Based Platforms

-

On-Premises Platforms

By End-User

-

Banks

-

Non-Banking Financial Companies (NBFCs)

-

Fintech Companies

-

Credit Unions and Cooperatives

Regional Analysis

-

China: The largest market, driven by strong fintech ecosystems, regulatory support, and consumer demand.

-

India: Rapid digitization of financial services, supported by government initiatives like Digital India and the Unified Payments Interface.

-

Australia and New Zealand: Mature financial systems adopting advanced analytics and open banking.

-

Southeast Asia: Fast-growing markets including Indonesia, Vietnam, and Philippines with increasing fintech penetration.

End-User Industries

Digital lending platforms serve diverse industries including retail, e-commerce, automotive, real estate, healthcare, and education. The most significant adoption is in consumer finance and small business lending.

Market Size and Factors Driving Growth

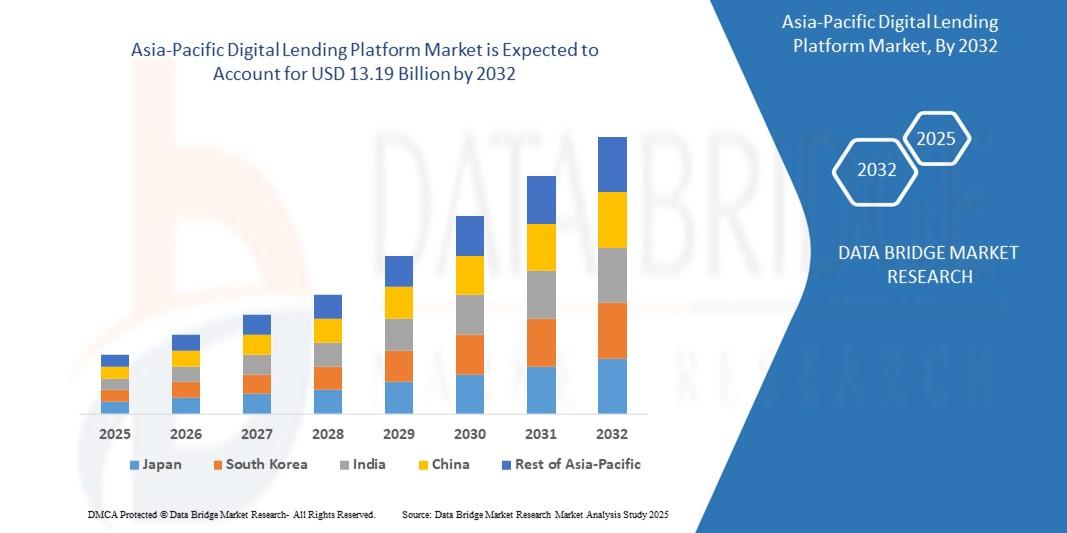

- The Asia-Pacific digital lending platform market size was valued at USD 3.01 billion in 2024 and is expected to reach USD 13.19 billion by 2032, at a CAGR of 20.3% during the forecast period

Key Growth Drivers:

-

Technological Advancements: AI, machine learning, big data analytics, and cloud infrastructure are transforming lending operations and reducing costs.

-

Financial Inclusion Policies: Governments are promoting digital finance solutions to extend credit access to unbanked populations.

-

Rising Fintech Investments: Venture capital and private equity funding are accelerating innovation and platform development.

-

Consumer Demand for Instant Credit: Digital-native consumers expect quick, paperless loan approval and disbursement processes.

-

SME Sector Growth: Small and medium-sized enterprises increasingly seek fast, flexible financing to support business expansion.

-

Open Banking and API Integration: Regulatory mandates for data sharing are creating opportunities for new lending models and partnerships.

Opportunities in Emerging Markets:

Countries such as Vietnam, Philippines, and Bangladesh offer significant growth potential due to large underbanked populations, expanding mobile networks, and supportive regulatory frameworks.

Conclusion

The Asia-Pacific digital lending platform market is on a high-growth trajectory, fueled by technological innovation, growing consumer demand, and government-led digital finance initiatives. By 2035, the market is expected to become a cornerstone of the region’s financial infrastructure, serving both retail and business segments with scalable and efficient credit solutions.

Innovation and sustainability will remain key to long-term success. Platform providers that invest in advanced analytics, cybersecurity, and inclusive credit models are likely to secure competitive advantages. The region presents lucrative opportunities for fintech startups, traditional banks, and technology vendors aiming to reshape the lending landscape.

FAQs

Q1: What is a digital lending platform?

A digital lending platform is a technology-based system that enables financial institutions and fintech companies to manage the entire lending process online, from loan application to disbursement and repayment.

Q2: What is the current market size of the Asia-Pacific digital lending platform market?

The market is currently valued at around USD 6.8 billion as of 2024.

Q3: What is the projected growth of this market?

The market is expected to grow at a CAGR of approximately 21% between 2025 and 2035, reaching about USD 46.5 billion.

Q4: Which countries are leading the Asia-Pacific digital lending platform market?

China and India are the leading markets, followed by Australia, Indonesia, and Vietnam.

Q5: What are the major factors driving market growth?

Key drivers include technological advancements, rising fintech investments, financial inclusion initiatives, and growing demand for instant credit.

Q6: What are the main challenges for this market?

Challenges include regulatory complexities, cybersecurity risks, high initial costs, and competition from traditional banks.

Q7: Which industries are adopting digital lending platforms the most?

Major adopters include banking, e-commerce, retail, automotive, and SME sectors.

Browse More Reports:

Europe Benign Prostatic Hyperplasia Devices Market

Middle East and Africa Benign Prostatic Hyperplasia Devices Market

North America Benign Prostatic Hyperplasia Devices Market

Europe Bio-Based Lubricants Market

North America Bio-based Lubricants Market

North America Bioherbicides Market

Asia Pacific Bioherbicides Market

Europe Bioherbicides Market

North America Bio-Implants Market

Europe Bio-Implants Market

Asia-Pacific Bio-Implants Market

North America Biomarkers Market

Asia-Pacific (APAC) Biomarkers Market

Europe Bonsai Market

Asia-Pacific Bonsai Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Music

- Travel

- Technology

- AI

- Business

- Wellness

- Theater

- Sports

- Shopping

- Religion

- Party

- Other

- Networking

- Art

- Literature

- Home

- Health

- Gardening

- Games

- Food

- Fitness

- Film

- Drinks

- Dance

- Crafts

- Causes